However, he was on the company’s board for over two years. This is probably what is being referred to.

![]() Pyysing

Pyysing ![]()

Now, if one really screws up, this figure of speech by Aki

will replace Black Peter ![]()

Edit: Is there ‘analyst commentary’ coming about this CEO selection? ![]()

for yourself and put monthly savings into a global index ETF (and only one ETF at that) and then continue your current approach with the other account? ![]()

This way, you limit risks, get more diversification, get to continue your own “risky bets,” and at least with part of your portfolio, you get to participate in the compound interest effect (upwards).

Then, over time, you compare the returns and adjust your thinking according to the results, seeing which feels better in the long run. At least for me, an index portfolio built between 2006-2010 has been on hold (I still own it), and after that, I directed all my money into direct investments. The results from direct investments have been quite good, but with indices, you get incredibly good risk-adjusted returns in the long run with incredibly little effort.

I am shifting my focus back to indices as I want to reduce the risks in my portfolio, even though direct investments are always so nice(!).

I personally feel that keeping a “comparison portfolio” teaches experientially even better than reading some academic research on the benefits of indexing. Some of us have to learn the most effective things for ourselves through practical experience.

Just a thought, each of us has our own way of investing. ![]()

But perhaps you can still serve as a good positive example through learning someday? Over time, it’s also possible that you find your own investment style in direct investments with a positive expected return. Live and learn.

All the best to you also in the form of investment returns. You’re doing great work on this forum. ![]()

Yeah, definitely with these specific index funds and ETFs, I will 98% certainly get better returns. ![]() With good luck I could win, of course, but the chance is really small.

With good luck I could win, of course, but the chance is really small. ![]()

I did have them for a few years back then. ![]() A bit with that idea, and after that, many have, of course, suggested this good idea. Of course, I haven’t had them in these funds in recent years.

A bit with that idea, and after that, many have, of course, suggested this good idea. Of course, I haven’t had them in these funds in recent years. ![]()

From the perspective of returns, it would be best to put everything into them, that cannot be denied. ![]()

Same to you and thanks for the good thoughts + thanks for the compliments!

Have a nice weekend everyone! ![]()

Dearest Verneri!

The former thrill-seeking investor, who hunted risk and lived by story stocks. The portfolio’s volatility was high, and especially upwards, it climbed at a furious pace. The entire forum and the rest of Finland waited with bated breath to see what sexy small-cap company that man had now researched and loaded up on, balls-deep, in his portfolio.

What happened? Well, the Helsinki market did its job, and little by little, the almost all-Finnish investor started looking for help from abroad. Now, about 35% of the portfolio is from outside Finland, and what’s more, 16% in interest/cash investments? For a stock picker? Peek-a-boo Verphu, choo choo?

The Helsinki market has clearly done its job when even the toughest stock-picking megastars have given up on the domestic market, packed their bags and left to shotgun 14x approx. 6% or less stakes in stupidly named companies into their portfolio (=wimp). The portfolio review is no longer filled with positivity and painting a bright future, but instead settles for explaining why this stock will likely fall less than the neighbor’s stocks.

Where has our Bull gone? ![]()

The writing may contain sarcasm.

I’m replying here so it doesn’t go into the company thread.

Many thanks for sharing. In my opinion, Kauppalehti required a response.

I certainly don’t intend to participate in Posti’s offering. It’s hard to see how one could make money from that deal.

You’ll at least earn the amount of that growing dividend ![]()

![]() Posti will surely bring the investor’s salary annually. It might not be worth waiting for it in the account on schedule, but it will come eventually!

Posti will surely bring the investor’s salary annually. It might not be worth waiting for it in the account on schedule, but it will come eventually!

I just walked past the living room and my wife had paused the program. I didn’t dare ask what it was about, but it gave a strong work vibe to a retiree ![]()

The state’s greed will likely guarantee ample dividends in the coming years. So dividend investors and other holders might be interested.

A reviled hot dog stand withering away. These postal dividends do not interest me.

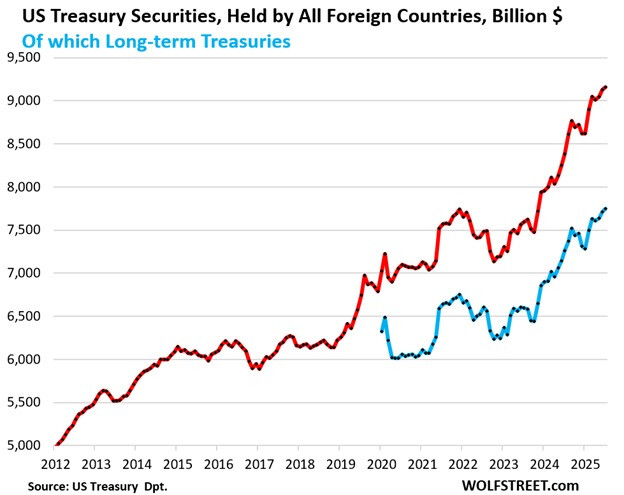

Foreign holdings of U.S. debt securities rose in July to new record highs, reaching $9.16 trillion.

Japan, Great Britain, and the Eurozone increased their holdings, but on the other hand, China’s holdings fell to their lowest levels since 2008.

https://x.com/KobeissiLetter/status/1969056630370169146

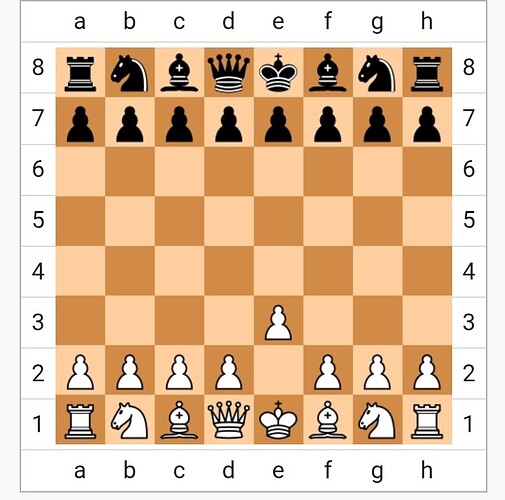

“What is likely happening in the picture?” is a better-phrased question, and the answer is not related to mysticism.

What data do we have in the picture? Black’s opening formation. White has played the move e3. White may have other moves, but there is no data on them. Therefore, it is most likely the Van 't Kruijs Opening.

From Wikipedia:

1.e3 is the eleventh most popular of White’s opening moves. In games from ChessGames.com’s database featuring the Van 't Kruijs Opening, Black has won approximately 45 percent of games against White’s 35 percent.\[1\]

However, the move cannot be called bad, as 1.e3 does not create weaknesses in White’s position and often leads to a reversed French Defense if Black responds with 1…e5, where White plays with a tempo advantage. Another common transposition is to the Queen’s Gambit. For example, in the continuation 1…d5 2.d4 e6 3.c4.

The opening is not popular among top players, but for example, Pavel Blatny, Aron Nimzowitsch\[2\], and Bent Larsen\[3\] have used it. Garri Kasparov also played 1.e3 against Fritz with the intention of getting the program out of its opening library.

Comment in the print newspaper; “We will get a positive example and a successful listing,” meaning this is guaranteed to be a successful listing, they will come in cheap and pay a large dividend in the spring. I will either go for a quick play if available, or hold it in my portfolio for a maximum of the time until the spring dividend is announced and fully priced in.

The cash has already been cleared for the state as an additional dividend (1/2025) this year, and debt has also been taken for that purpose, and for the assumed large dividend next spring. To stabilize the financial situation, an offering will come a little later with some suitable excuse that resonates well with investors, “International expansion,” at which point I no longer intend to be involved in paying the final bill for the State’s profiteering.

Here is an article from SalkunRakentaja about dividend aristocrat Procter & Gamble. ![]()

Strong brand identity and innovative product development help it stand out from competitors and enable the maintenance of premium prices as well as consumer loyalty.

In addition, the company utilizes extensive risk management, such as currency hedging and operational diversification, which help the company maintain earnings stability and succeed even during economically uncertain times.

The company is highly profitable. Its return on equity was over 30 percent last year.

Based on next year’s consensus estimate, the company’s P/E ratio is 23x, meaning the market prices in the company’s high profitability and strong dividend-paying ability.