In my opinion, the most attractive engineering company now is:

- Hiab

- Kalmar

- Konecranes

- Kone

- Valmet

- Wärtsilä

- Metso

In my opinion, the most attractive engineering company now is:

@Sijoittaja-alokas has subtly trolled the politics corner by changing the letter ‘n’ in the title to a Cyrillic ‘п’. ![]() Politics bubblegum?

Politics bubblegum?

I’ll throw Raute in as a wild card, but I don’t find the sector particularly attractive at the moment. Most have already taken a significant lead. In addition to Raute, at least Ponsse, Kesla, and Norrhydro are also missing from the options.

I’m puzzled by the lack of alternatives in the discussion about share buybacks, which seems to advocate for a single truth aiming to prohibit either dividends or buybacks?

I personally see a purpose for both and I value companies that first clearly communicate what they intend to do and then execute their strategy year after year.

My own approach involves passive growth funds that are sellable with a deemed acquisition cost assumption (for tax purposes) for holdings over 10 years, and outside of those, an Oksaharju-style dividend portfolio to ensure that sirloin steak and El Cortez XO don’t run out from the table even during a downturn, when it’s not advisable to sell funds. I can generate my own dividends by selling funds when I get a reasonable price.

Telia is not directly found in my portfolio, because selling off parts of the company and paying dividends from cash is not sustainable. The dividend portfolio manager saw that even before the dividend cut.

I said “you can sell,” not that you have to. In the end, it’s always the investor who takes a view on whether a stock is cheap or expensive, and that’s always the case regardless of whether dividends are paid or own shares are bought back.

If you don’t want to sell when the price is low, but absolutely need income, you’re in the exact same situation even if the company temporarily suspends dividend payments to protect its cash. I, for one, would not agree to a situation where I outsource my cash management to my investment target, and I don’t really believe this is your situation either.

If, on the other hand, income is a nice bonus but not strictly necessary, then you simply don’t sell when the price is low and take your “dividends” at some other time? I still genuinely don’t understand how anyone else can win in the long run here besides the tax authorities.

This didn’t quite open up what was at stake and who would be annoyed? I, for one, would only and exclusively want the company NOT to take a stance on valuation and always buy back its own shares with surplus funds, also enabling the “tracksuit wearer” (average investor) to choose the most tax-efficient profit distribution for themselves.

Sorry for the double post, but I wanted to reply to this as well: this is another thing I don’t quite understand. It’s a very good idea to get a deemed acquisition cost with a long holding period, but dividends are always taxed on the full amount (assuming they are taxable).. So again, I don’t understand that if one wants income, how are dividends a better option than sales proceeds? The exact same result should come from them if the acquisition cost is zero, but otherwise selling should be more advantageous?

It’s possible that I just don’t understand, so if that’s the case, please provide me with a calculation explained simply, thanks ![]()

The dividend discussion reminded me that dividends often have a clearly stated track record from companies spanning years or even several decades (in the United States, there are companies that have continuously increased their dividend every year for up to 70 years). A list of so-called dividend kings: 2025 Dividend Kings: List & Definition | The Motley Fool Usually, companies also have their entire dividend history on their own investor pages.

It is considerably more laborious to find data on the history of share buybacks (and cancellations) and stable growth/predictability. ![]()

Hello,

This morning I read a comprehensive article titled “The Workplace of Broken Dreams,” which discusses the operations and corporate culture of the Finnish software company Dream Broker → https://x.com/JuhaHaanpera/status/1965110800076734824

The article brings to light many employee accounts of fear-based management, workplace problems, and leadership practices that have affected both staff well-being and the company’s reputation. I don’t know the company or its people personally, so I don’t want to judge. Elina has done thorough journalism and interviewed various parties comprehensively. The article made me reflect on the significance of employer branding and corporate culture for business:

Brand value in the eyes of customers: Company values and internal culture are an increasingly important part of customers’ decision-making. Openness and good treatment of staff build trust, and a lack thereof can weaken the brand, especially when news coverage is extensive.

Recruitment challenges: Competition for talent is fierce, and employer branding is a significant factor in attracting and retaining top talent. Negative publicity can make recruitment even more challenging, as the article describes.

Company values and their visibility: It’s interesting to ask how much a software vendor’s values are visible externally to customers and investors. I wonder if they affect purchasing decisions? Or do technology and business results ultimately weigh more?

Leadership development: Every organization has the opportunity to learn and renew itself. When a company’s challenges are openly brought forth, they can also serve as an impetus for developing culture and leadership. The article was a striking reminder that corporate culture is not just an internal matter. It directly affects the brand, business, and ability to grow.

It’s a bit like pointing out to an enraged wife that she is now irrational & overreacting. This way she immediately understands her mistake, and calms down ![]()

Are there any dividends that would be fully taxable? For stock exchange dividends, 15 percent is tax-free for normal individual investors. And if one owns enough, stock exchange dividends can be received completely tax-free.

Sorry, my bad. So indeed, only an 85% share, I had somehow completely forgotten that, meaning the limit is at a slightly different point. I haven’t really ever had to think about it myself, as I haven’t had any 10-baggers in my portfolio, and therefore the sales profit is always a very small percentage ![]()

In the dividend discussion regarding Finnish stocks, it’s good to remember Esa Juntunen’s wisdom from his book ‘Viisas sijoittaja’ (Wise Investor): “Finns are dividend investors, but Finnish companies are not dividend-investor friendly.” On the Helsinki Stock Exchange, there hasn’t been a single company that has increased its dividend for 20 consecutive years. For a long time, my own thinking was guided by Seppo Saario’s idea that the best company is one that increases its dividend. With the accumulation of investment experience and knowledge, I have come to understand that the method of profit distribution doesn’t really matter to me. It would be great if Finnish companies found sensible investment opportunities, but in Finland, a company is considered bad if dividends are not 70-90% of earnings.

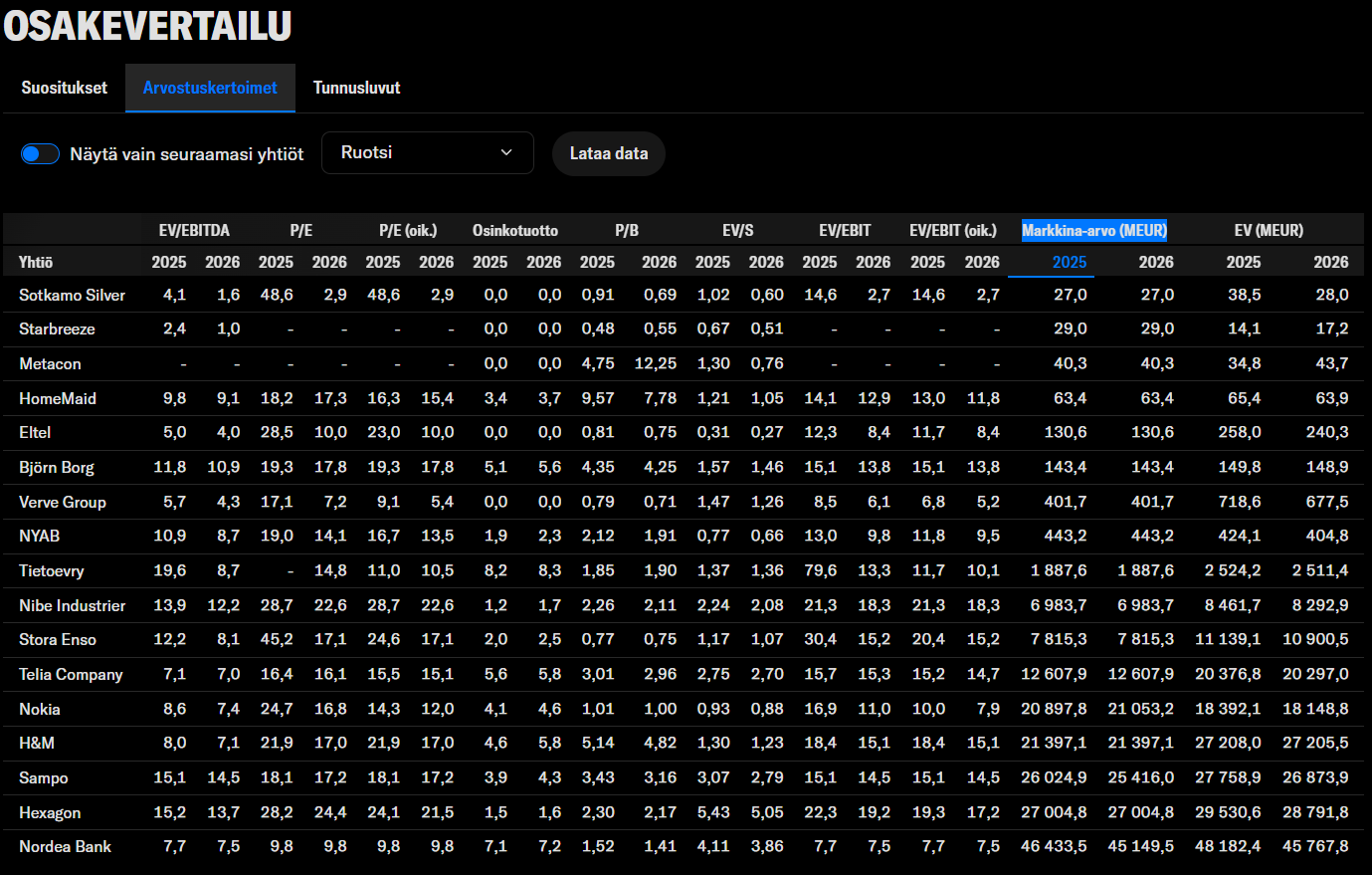

I wish at least some of these “good cases” among Stockholm’s small-cap companies were under the scrutiny of an independent analysis firm, so that as a private investor I would have time to research them more in the evenings, e.g., with the help of extensive reports ![]() @Mikael_Rautanen

@Mikael_Rautanen

Sorry to interrupt a good dividend discussion, but this message might be better suited for the coffee room than the bragging thread. To write about portfolios worth hundreds of thousands, one should be able to speak in the plural. On the other hand, some of the text would fit into the “car as a brake on wealth accumulation” thread (I switched to a company car and sold my own car → this brought almost €20k into the portfolio) or the “betting” thread (I won a total of about €10k from Veikkaus games within a couple of days, almost all of which also went into the portfolio).

My portfolio, you see, broke into a new tens of thousands today, thanks to Planet’s 40% up day. YTD was still 98% at last Friday’s close; today the portfolio is up 5%, meaning it has now more than doubled since the beginning of the year. I also have about 25% in cash (I should prepare for additional taxes to be paid next year). Of course, in a bull market, almost anyone is a good investor, but I think that after a few much leaner years, I have finally found a suitable investing style for myself. This forum has provided many good insights and ideas that I have applied. Good tips include keeping a maximum of 10 stocks in the portfolio at a time (more is difficult to follow). Many also advocate diversification. For me, however, I have such small stakes that to achieve real returns, I need to take big risks and take a strong view.

Unlike before, I have dared to cut losses quickly, and on red days, I have sat on my hands (or, when a bad moment came, exited the ride for a while only to return when the outlook improved). And I have also remembered to keep a cool head when there was an opportunity to cash in profits. Previously, things often went exactly the opposite: I clung to large losses with tooth and nail, while good uptrends were missed too often when greed struck, and I couldn’t bring myself to sell when I was already well in profit.

The biggest gains have been made with HIMS (approx. 1100% return with a three-year hold, plus swings), JOBY (120% return), Planet (average 170% return), and Ondas (which stayed in the portfolio for only a few weeks, approx. 120% return). Of course, I have followed the other companies in my portfolio for years, with Ondas being an exception (I still owe beers to forum members, by the way).

A funny detail in this “betting” is that I’m not even a very good investor: I do far too little fundamental research or calculate company valuations. I don’t even really know technical analysis at all, at least not well enough to make decisions based on it. However, by growing my own capital, I have gained enough volume for trading (I mean in this context that I can play with thousands rather than hundreds, which means the returns are also larger - though so would the losses).

Well, this message probably went more into self-reflection or perhaps even self-praise. I just have a good ‘feeling’ about this right now and wanted to share the emotion. Because you can’t really brag about things like this on your personal social media or at work, for example ![]()

The football match Israel vs. Italy ended with a score of 4-5. Only one Israeli managed to score.

This is a perfectly valid point. In Finland, things are often viewed from the perspective that the population should be a certain size. At the same time, technological development solves this problem almost incidentally, as processes become more efficient and cost-effective. I’ve always wondered why we should bring, for example, cleaners to Finland, when at the same time, even just on the consumer side, there’s already such advanced technology available for this problem that virtually the most time-consuming tasks could have been outsourced to robot vacuum cleaners ages ago. And cleaners are just one of numerous examples.

This is again a good indication that it’s technology, not politicians, that solves problems. For this reason, politicians and leading figures should be very well aware of where technological development is heading at any given time.

Vacuuming and floor washing are a relatively small part of what cleaners do. Automating that part probably doesn’t play a very big role in the work, and the cost of that automation is clearly too high compared to the benefit for now. Robots are, for example, quite bad at moving things out of the way, which means floor cleaning remains quite incomplete. Of course, if we’re talking about a gym-style floor with nothing in the way and a large surface area, a robot would certainly be a good aid for a cleaner, if the cost is reasonable.

So as not to dwell on just one detail, I think that example illustrates the current state of technology well (robots, AI). They can be helpful, but they are far from being able to completely replace humans.

I disagree with this, though. From what I’ve observed, the majority of a cleaner’s time is indeed spent on cleaning floors (first dusting, then wet mopping) and washing mops in between. This is at least the case in an office when talking about weekly tasks.

I’ve also been advised to put sarcasm warnings on certain posts, but I won’t until the forum naz…police do.

Not even Erkki can distinguish these from real life

My wife was ranting about how women are so much better than men in every single way. I tested with easy things first. I told her to calm down and sit down.

Neither worked.

I’d gladly take credit for this discovery and sharing it on the forum, if the company develops well in the future ![]() .

.

And if it turns out