If one could create a “Dividend-Robinson” service where all limited companies would be forbidden for a fixed period from paying dividends to an account, and the company would then buy the same amount of shares from the market and transfer them to your ownership, I would sign up for it immediately ![]()

If my dividend rage seems unreasonable, it’s due to the continuous need to deal with authorities in several different foreign countries regarding the correction of dividend taxation, because they have these dividend withholding taxes, which are a completely unknown topic to the Finnish tax authorities. All this unnecessary hassle around taxes could be avoided if not a single company in the world would ever pay dividends again.

![

So, share buybacks are precisely a strategy-neutral way of distributing profits. In that situation, you decide yourself how much profit you withdraw and when. Dividends are forced down your throat without you being able to genuinely influence their amount or timing.

I genuinely find it difficult to comprehend that in the year of our Lord 2025, there are still counterarguments to this when it is purely a matter of arithmetic? By distributing dividends, the only sure winner is the tax authority, and that also comes out of the pockets of dividend believers (I won’t even mention the >10% share loophole at this point).

I have occasionally wondered about this aloud, and the answer is always either a thousand-dollar bill, immense indignation and an explanation about “valuation” which has nothing to do with the matter because you can always sell yourself the dividend, or “yes, I know math too, but try explaining it to the dividend party.”

I have wondered about this aloud from time to time, and the answer is always either a thousand-dollar bill, immense indignation and an explanation about “valuation” which has nothing to do with the matter because you can always sell yourself a dividend, or “yes, I know math too, but try explaining it to the dividend party.”

Perhaps dividends are at the core of ontological questions, and the fact that people are willing to pay more for dividends than for share buybacks is the battleground for the metaphysical subjectivism/objectivism struggle, where we must conclude that despite all their arithmetic logic, share buybacks are simply not a reality in our fringe stock market universe, or even desirable for that reason. They cannot form a categorical imperative due to the bias of human experience, and one can only wait for growing autumn dividends, quoting the famous Finnish small investor: God is dead, where are the real dividends?

[quote="Wallet

people are willing to pay more for dividends than for share buybacks

Probably so. What’s interesting, however, is who ultimately decides on the matter when it’s decided in the same direction year after year? We ordinary folks can have any opinion on the matter, but that famous “someone” who gets the boards and management of listed companies to favor dividends is also a member of the dividend camp.

Thus Spoke Osinkko

Here, if I recall correctly, the highest form of human was Überdividend. There is also the horse theory regarding Nietzsche’s mental breakdown. According to it, Nietzsche would have seen a man beating a defiant horse almost to death. Nietzsche had run to hug the horse, crying, and seen how representatives of a Finnish telecom operator had arrived, who had more dividend money than could be distributed in a single spring. The pain and damage caused a strong methane reaction in the horse, as a result of which the Finns bought German magic air for 4.3 billion, the sight of which and a quick reflection on his own production drove Nietzsche into an 11-year institutionalization, and he never returned to even half of his mental and physical faculties.

I have wondered about this aloud from time to time, and the answer is always either a thousand-euro bill, immense indignation and an explanation about “valuation” which has nothing to do with the matter because you can always sell yourself a dividend, or then “yes, I know math too, but try explaining that to the dividend party.”

In response to the bolded part, yes I can, but I don’t want to sell in spring 2020, and that wasn’t the only year when generating dividends by selling would have been disastrous.

My reasoning is not a thousand-euro bill but an average earner’s annual salary in dividends, and for some time still, a dividend sum growing over 20% per year, until the slowdown in additional purchases bends the growth of the pension portfolio’s dividend sum to a smaller double-digit percentage.

Of course, I could liquidate a hundred thousand in reserve money from my portfolio for a couple of weak years, but that would be out of a portfolio generating returns with a 100% equity weighting.

The “buyback party” sounds a bit oversensitive when even a request to buy back shares at a reasonable price causes resentment?

Finns bought German magic air for 4.3 billion

They didn’t buy it.

They bought a vacuum.

Radio waves don’t need air. There has to be some sense in sarcasm too! ![]()

Fortunately, Germany cannot sell the space above it, otherwise these radio signals would have traveled through brutally expensive German air. I don’t know if it was somehow magical, but based on the price tag, one could imagine so.

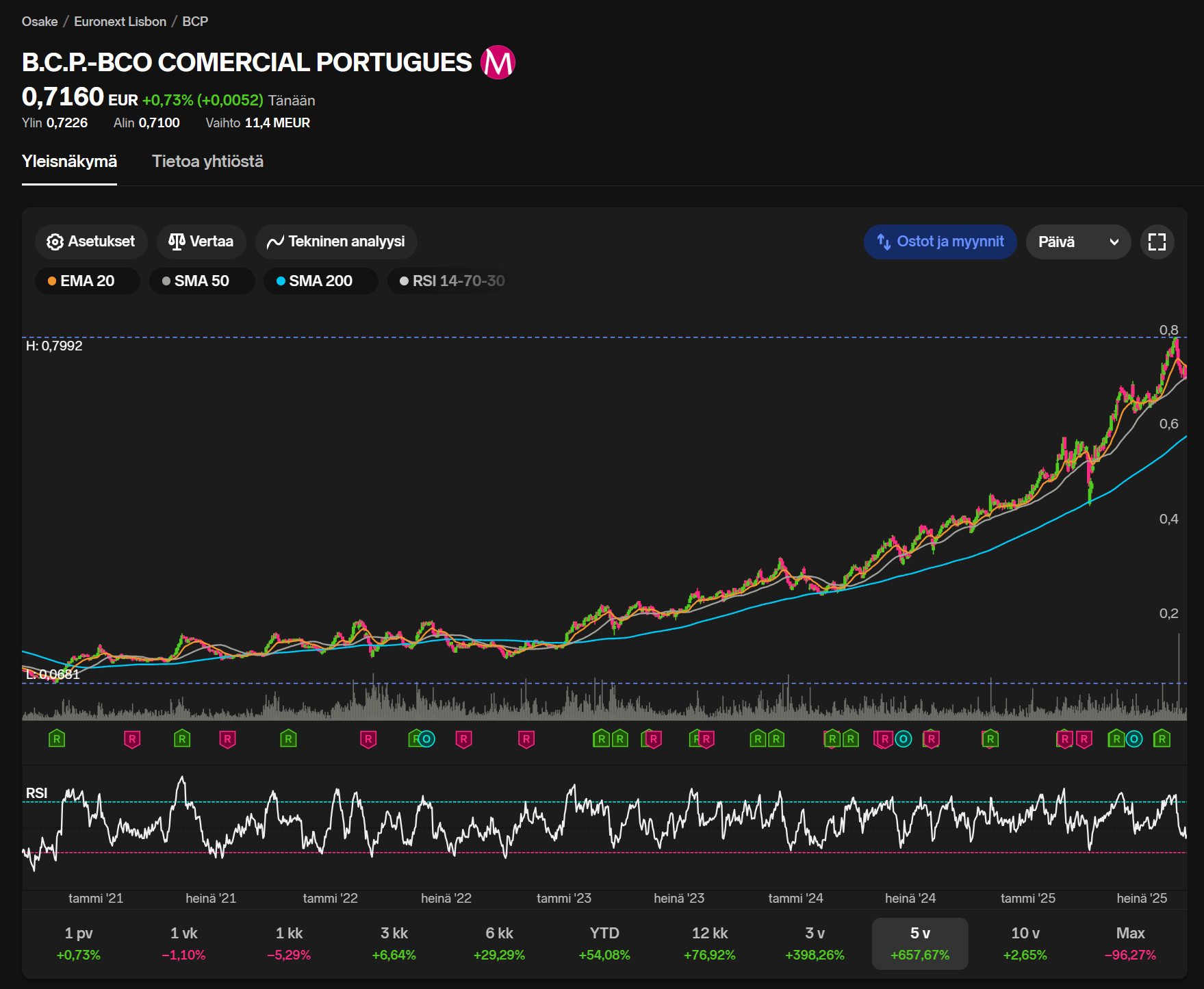

the BCP commendably brought up by

a bit

Were you trying to confuse things a bit with that letter order?

All this unnecessary hassle around taxes could be avoided if not a single company in the world would ever again pay dividends.

Wealthy women and other owners of unlisted companies:

Without getting further into the dividend and share buyback discussion, I have noticed that in years of decline, I haven’t had to pay taxes on dividends in Finland.

Whenever a position is sufficiently in the red, I sell the shares, and the next day I consider whether to buy back the same shares or something else. If I buy back the same ones, I usually slightly increase the position at the same time. With these losses, I have offset the (Finnish) taxes payable on dividends, and the next day the position has been slightly larger again.

Nowadays, dips are quickly recovered, so one has to act quickly to be able to realize the losses.

Of course, the problem of loss-making stocks only exists for bad investors like me, who don’t know how to buy only rising stocks.

Were you trying to confuse things a bit with that letter order?

Clearly a deliberate prank for those who just follow along without bothering to read the justifications.

On the other hand, this BCP certainly looks quite attractive based on the price curve. European banks have good momentum, and this could now be bought from a rising MA50.

Exactly ![]() , you should have taken a picture of that Max timeframe, it looked a bit different…

, you should have taken a picture of that Max timeframe, it looked a bit different…

Private messages also streamed in from the same electricity calculation tool, and it certainly looks like one could save real euros. Perhaps I should try to overcome my natural laziness and indeed switch to spot market electricity.

The next question naturally challenging my natural laziness is whether the forum has achieved significant savings by comparing insurance companies?

Everyone surely agrees on this, and that’s why it’s repulsive that companies force dividends into accounts completely unasked or without offering any alternative to not receive the dividend.

Yes, even in Helsinki (Stock Exchange), there are many companies that protect the owner from unnecessary taxes by making so much loss that many owners can, through active selling, utilize the reduced owner value in taxation.

A Finn is willing to pay even big money just so nothing goes to the tax authorities.

Only the CEO’s face video is missing, but that is usually the least value-adding network bandwidth wasting component of the broadcast.

This is the most value-adding part of those video releases. How the CEO seems when presenting figures and the past. Everything else can be read from the report.