If you look at the management team and everyone’s details on Faron’s website, Vesa Karvonen owns 104,000 shares and, for example, Dekkers doesn’t own any shares, so one could interpret that list as being accurate?

I don’t have an answer to this. I’m not doing anything with my own shares, because I don’t know what would be a sensible move. I was present at the last CMD and I generally appreciate interaction through traditional means. Mainly, I’ve been fed up with this lack of communication and thought I’d do something about it.

Ps. I’m definitely going to the next AGM

On Faron’s investor pages, Yrjö’s title is still CFO, so I wouldn’t consider those pages a primary source of information for pretty much anything:

I’m personally taking a brief look at Faron’s Management Team. Yrjö is a senior advisor there.

The chatter is intensifying, the deal is approaching. The most active ones seem to be those who don’t have a position in this, looking at the statistics below.

How the hell is Paavo giving information over the phone to an individual shareholder? Let’s all give him a call then, since he doesn’t bother communicating here (either).

What kind of two-bit outfit asks individual shareholders to call them? Couldn’t that have been handled quickly with a message?

Shady if true. Not that we know for sure.

It certainly seems very likely that Faron will only go public once a decision regarding the way forward has been made. It would be quite reckless to start communicating publicly, for instance on this forum, if negotiations with one party or another are still ongoing.

Let’s catch our breath for a moment and tip our hats to Sirpa:

Forbes’ “50 Over 50 Global: 2026” is an international list compiled by the ForbesWomen editorial team featuring women who have achieved significant influence, leadership, or innovation over the age of 50. The list highlights leaders, founders, creators, and innovators from 36 different countries and territories.

She is one of them:

Professor of Immunology, University of Turku | Finland

Sirpa Jalkanen

Immunologist Sirpa Jalkanen has focused her research on the traffic of the cells that cause cancer and other harmful inflammations, and on therapies that can treat these illnesses. This focus has led to discoveries that have resulted in 11 approved patents and two biotech companies (BioTie Therapies and Faron Pharmaceuticals). Though Jalkanen is a cofounder of both companies—the latter of which trades on the London Stock Exchange—she prefers to keep her day-to-day work in the realm of academia. She has published more than 300 peer-reviewed papers, and in 2024, early clinical trial success for a therapy targeting acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS) made Jalkanen a finalist for the European Inventor Award.

Thanks for the activity and information ![]()

I’m splitting hairs here, but if there are indeed discussions ongoing with partners—and not negotiations—then a share issue is coming in the near future. One can’t really conclude anything else from this terminology ![]() If this interpretation holds, it has a major impact on the investment strategies of many, including my own.

If this interpretation holds, it has a major impact on the investment strategies of many, including my own.

And as noted, the company’s communication is interesting, as information isn’t handled centrally, but over the phone to an individual investor. Strange. Many here have followed the company’s operations for a long time and warned about the Jalkanens’ optimistic comments, so my own stance is starting to turn skeptical, even though many things speak for themselves…

Yesterday, someone over on the London side raised what I thought was a somewhat speculative question. Could Faron be planning a listing on an American exchange?

Surely there are some financial experts on this forum?

Would such a thing even be “physically” possible? Wouldn’t the listing process itself require significant funds?

Markku already hinted at a US listing as one option back in the day. So it’s hardly impossible, although not very likely.

And intentions to list should be announced before any measures are taken. So, it is unlikely to happen at least until it is known how further operations will be funded.

I understand Faron’s situation and the tight-lipped stance, but at the same time, I feel that the sand in the hourglass is running out at an accelerating pace. Decision-making is certainly very painful, as brilliant outcomes are no longer on the table. As I see it, at some point Faron must realize that “good” has to be enough, unless they want to move into the “satisfactory” and “passable” categories…

I base my view on the scarcity of funding and its inadequacy relative to the set goals and strategy. As we have observed, there is a long way from partnership discussions to a partnership agreement. Time is running out for good deals because Faron inevitably finds itself with its back against the wall from time to time. The next time will be by March at the latest. A third problem is investor communication. At some point, as the share price erodes and drivers weaken, I don’t believe Faron can rely on the unreserved support of investors anymore, at least not to the extent that it would carry them across the “valley of death.” The required amount of capital, risk, and time are significant contraindications.

What remains are “rabbit out of a hat” type unpredictable and surprising means. One of them could be a US listing. Without taking a further stance on that, I hope that the solution (whatever it may be) supports shareholder value and respects Sirpa’s legacy & contribution. Ultimately, Faron’s mission of honor and responsibility is to bring bex to market. The mission is to save & improve cancer treatment and prognosis. This is something that commercial “fumbling” should not be allowed to botch. The starting point is to replace these dark, murky, and cloudy times with at least some sunny spells.

Time is…..

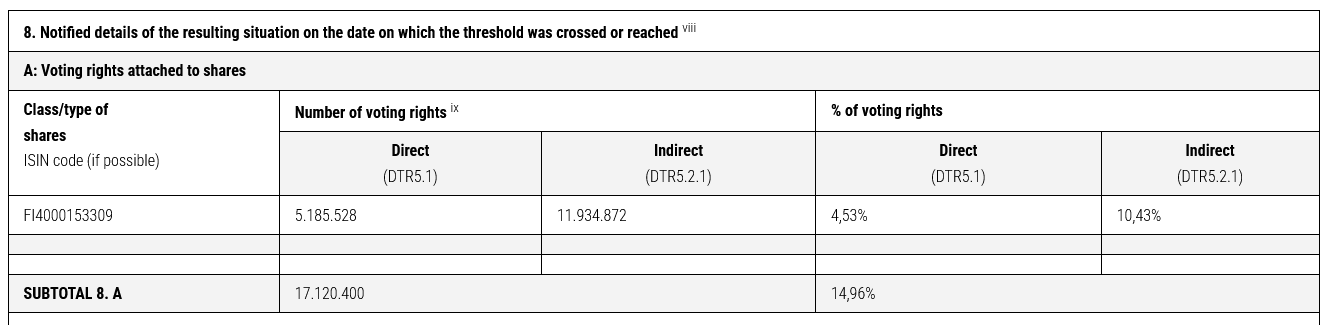

I checked the shareholdings of the rest of the management as well, and they seem to be the same as those presented on Faron’s website. One slightly odd discrepancy was that Juho has 45 shares more than what is shown on the site. Syrjälä’s personal holdings are 4,214,774 shares. The status of the Acme investment company cannot be accessed through Euroclear; changes in its holdings will only become public once the five percent thresholds are breached in one direction or the other.

Syrjälä has since sold nearly a million additional shares from his personal portfolio after the last flagging notification:

Based on what data? According to Faron’s Shareholders list, Syrjälä still holds the same 17,120,400 shares.

Listing in the US will bring nothing but expenses. What would be the point of that? A more liquid stock? We’d just get more short sellers and reach the bottom faster? At the same time, a share issue would have to be carried out, and even then, I can’t think of any particular benefit from a US listing.

Based on the data above:

On Faron’s website, Syrjälä’s holdings have been updated based on the above flagging notification as of December 3, 2025.

![]()

ACME’s holdings are behind a nominee register and do not update on the lists automatically. Syrjälä is also not an insider, so flagging notifications are based on crossing the 5%, 10%, 15%, etc. thresholds.