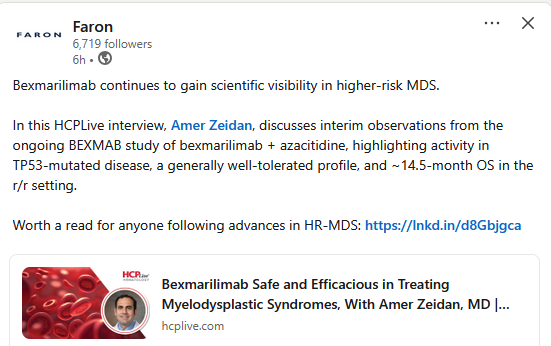

Since the wise heads of this forum still seem to be on holiday, I took the liberty of asking my own expert, who is an AI but not ChatGPT:

- New information: Differentiation by TP53 mutation status

This is the most significant new piece of information. Previously, Faron has spoken about responses more broadly, but here they have been broken down by TP53 gene mutation:

-

Treatment-naïve (new patients):

-

91 % ORR (wt TP53, i.e., wild-type/normal gene). This is a staggering figure.

-

78 % ORR (mTP53, i.e., mutated gene). This is the “difficult” patient group for which there are currently no good treatments. The fact that even in this group we are reaching nearly 80 percent is a very strong medical result.

-

Biallelic ORR: 83 %. This is very specific data on the most difficult form of mutation.

-

2. New information: R/R MDS (relapsed/refractory)

It was previously known that responses in R/R patients are lower, but here it is now in black and white:

-

74 % ORR (wt TP53). This is a very competitive figure in this difficult patient group.

-

46 % ORR (mTP53). Although the figure is lower than in new patients, it is still significant because the prognosis for R/R mTP53 patients has traditionally been very poor.

My “expert” explained that data as being so good from an investor’s perspective that I don’t dare add it here.