Aallon’s results day ![]()

And Ate’s comments

Aallon’s results day ![]()

And Ate’s comments

Good growth and profitability were achieved based on comparable figures. Although the result was slightly below the analyst’s forecast.

Yep, in the big picture, things are moving forward as they should! There’s always forecast risk associated with modeling these acquisitions, as there isn’t precise visibility into the profitability of the acquired targets or whether they have some kind of exceptional seasonality in H1 vs. H2. Now, there are also costs from the organizational restructuring on top of that.

In the earnings info, the atmosphere was again very relaxed, and at least so far, the organizational restructuring seemed to have progressed well. Here are some impressions in video format as well:

Here is a new company report from Aate on Aallon Group after Q2. ![]()

We reiterate our target price of EUR 13.0 for Aallon Group, but due to a slight share price increase and a decrease in organic earnings growth forecasts, we lower our recommendation to “add” (previously “buy”). Although our forecasts for the beginning of the year were slightly too optimistic, Aallon Group’s acquisition-driven growth strategy is moving in the right direction. The implementation of the organizational reform causes short-term uncertainty and costs, but enables the continuation of profitability improvement in the coming years. In our opinion, the share’s valuation (2026e adj. P/E 11x) looks moderate in relation to the company’s stable and strong cash flow generating business and medium-term earnings growth prospects.

Quoted from the report:

Despite the acquisitions made, Aallon Group’s balance sheet is strong, and adjusted for lease liabilities, it is almost net debt-free (H1’25: adj. net gearing 9%, reported 28%). Thus, the acquisition strategy can well be continued in the latter half of the year as well.

Almanakka has written about Aallon Group. ![]()

My shares were indeed sold because of these issues. Aallon might be better at handling employee and client leakage than its industry peers, but it’s certainly not completely immune. The valuation has also risen to a somewhat reasonable level, although it’s by no means challenging yet. The economic situation in Finland is probably at its weakest in a while. At some point, there might be tailwinds from there too, so perhaps not the optimal timing for sales.

What has Aallon’s strategy been with these small acquisitions? Will it continue as before, or will Aallon’s signs be put on the wall immediately?

Somehow, my faith is wavering in buying a 100-euro cloakroom in Kuusamo and profitably integrating it into a publicly listed company in the long run.

Owning Aallon Group is indeed a rocky road. However, owning an accounting firm feels very secure. In light of this, the valuation seems very reasonable.

Could the biggest stumbling block be the chairman’s own large ownership in the company? An external buyer could very well offer a much higher price for this gem if there wasn’t such a large anchor owner.

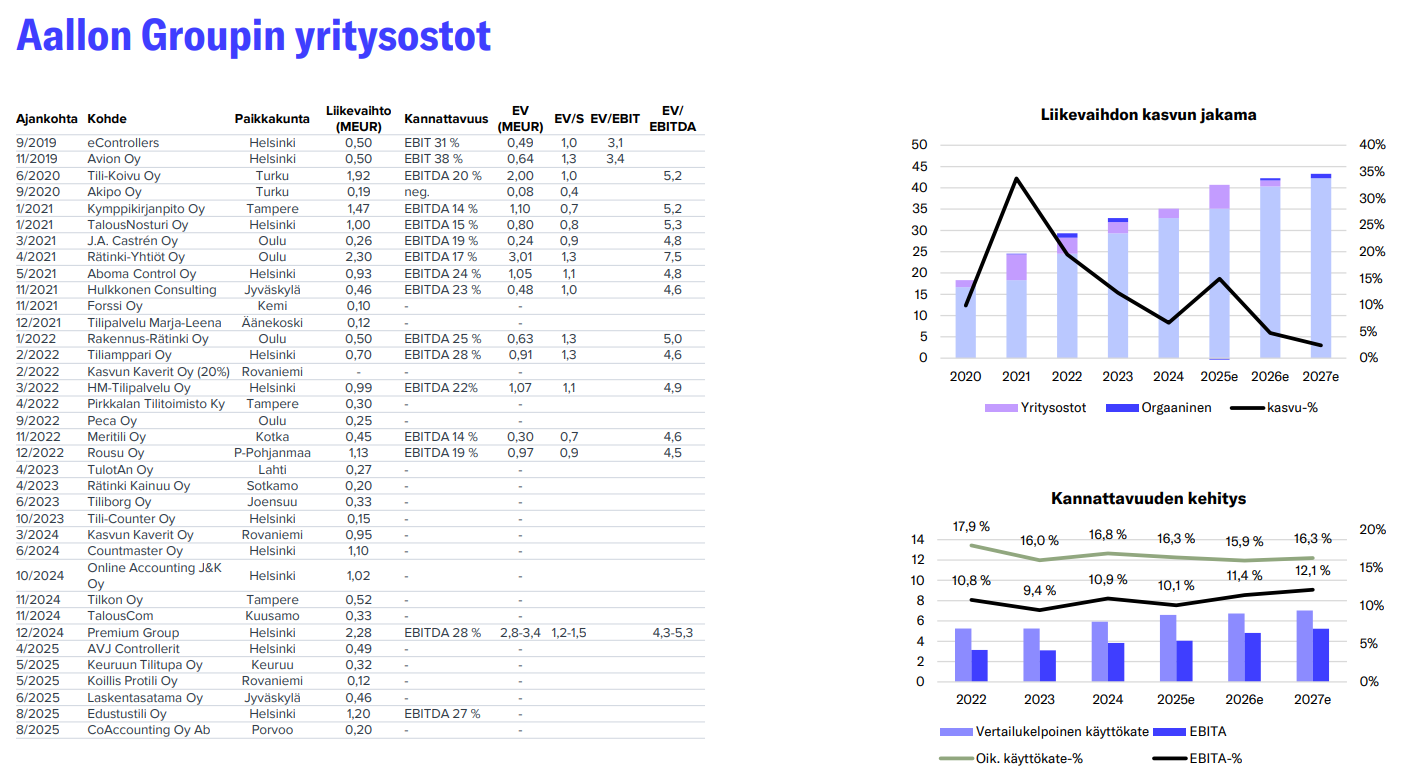

In Inderes’ comprehensive report (pages 18-19), the acquisition strategy was well described. In summary, one could say that the integration is softer than that of private equity-backed companies or, for example, Talenom, which forcefully pushes its own software onto accountants and clients.

Aallon Group has entered the accounting firm market

consolidation game with a different approach than private

equity-backed companies. The company sees its competitive

advantage in the fact that accounting firm entrepreneurs find it

easier to join an entrepreneurial company like theirs than to

sell their business to, for example, a private equity investor.

This “softer” approach gives Aallon Group a competitive

advantage in certain targets in the M&A market. We estimate

that almost all slightly larger accounting firms have already

been approached with acquisition intentions, but for everyone,

money alone is not sufficient compensation to give up their

business. For example, a retiring accounting firm entrepreneur

often wants to find a good successor for their life’s work.

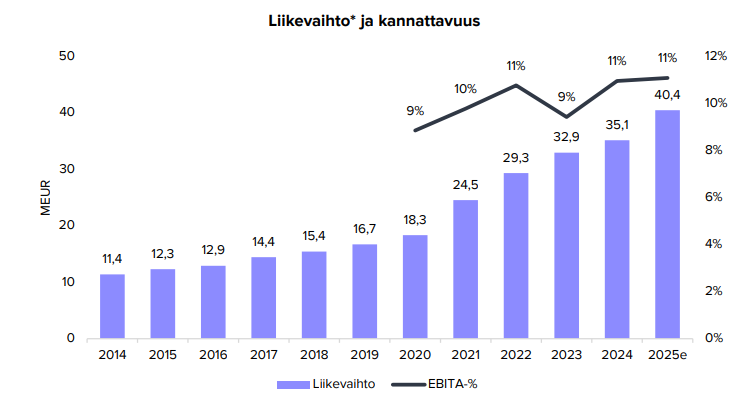

Historically, this softer approach has worked excellently, and value has been justifiably created when looking at financial development over a longer period. Revenue has grown impressively, and profit alongside it. This is a clear sign that no widespread problem has arisen, e.g., from customer or employee churn. Nearly 40 accounting firms have already been acquired, so one would expect issues to surface if there were something significantly wrong with the process.

In my opinion, the biggest question in Aallon Group’s investment story is how long these smaller, entrepreneurial accounting firms will remain available for acquisition, and whether their “soft” integration will continue to succeed, even as the organization constantly grows.

Nature of transaction: ACQUISITION

Volume: 1966 Average price: 11.24044 EUR

Nature of transaction: ACQUISITION

Volume: 1800 Average price: 11.17667 EUR

Nature of transaction: ACQUISITION

Volume: 800 Average price: 11.25 EUR

Put your money where your mouth is ![]() (looks like no company acquisitions will be completed anytime soon)

(looks like no company acquisitions will be completed anytime soon)

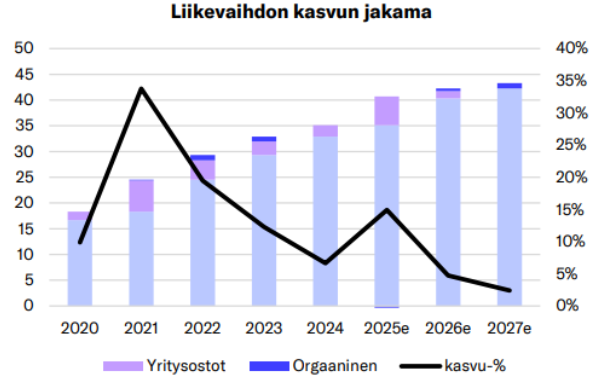

Being lazy, I can’t be bothered to start looking, let alone calculating. Has anyone come across information on how much revenue Aalto has acquired through business acquisitions and how much of it is “left”? Based on the earnings commentary, organic growth is at zero or slightly negative.

We estimated organic growth to be close to zero or slightly negative, in line with our forecast.

In my opinion, from the perspective of the acquisition strategy, it is concerning if acquired revenue starts to disappear more significantly.

Inderes’ report includes a table of historical acquisitions. From this, one can roughly calculate that approximately €24 million in revenue was acquired between 2019-2025. The latest acquisitions will be fully reflected in the 2026 fiscal year’s revenue, for which Inderes forecasts €42.3 million in revenue. If this is compared to, for example, the 2018 fiscal year’s revenue of €15.4 million, the growth has practically come entirely from acquisitions, and organic growth would have been minimal.

It is also possible that some acquisitions have not been as successful, leading to revenue leakage, and perhaps organic growth has been better in some areas? I would assume that some price increases have also been made over the last five years. I cannot assess this more precisely with the given information. However, I believe one can conclude from this that no dramatic revenue erosion has occurred in the acquired companies. Sometimes this certainly happens when many acquisitions are made.

EDIT: and in this graph, the distribution of growth is outlined

Seeing the Aallon logo in Kärsämäki always brings a smile to my face, but on the other hand, a wide service network is, in my opinion, a definite advantage.

Finland is full of small businesses that appreciate being able to employ people in their own area. Additionally, there is still a generation that enjoys meeting and chatting with partners at least occasionally.

Buying a 100k€ kiosk from Kuusamo can bring Aallon into the city’s(!) streetscape, where the next entrepreneur will then choose this accounting firm.

As a customer, when making the choice (we transferred the accounting for three kiosks to Aallon), I found that the sales process went smoothly, the service selection was broad, and the price was competitive.

Furthermore, Aallon can sell services to Kärsämäki or Kuusamo, even if the previous entrepreneur / company could no longer take on more clients. Aallon can check the accountants’ worklist & expertise and present the client with an expert specifically for their field.

There are also significant differences in accounting if, for example, the firm lacks expertise regarding EU subsidies or similar matters. A larger one is more likely to have it.

I am keenly awaiting whether Aallon can build more integrations into Portti for various enterprise resource planning (ERP) systems, which would certainly make winning new clients easier.

Thanks! Good point about the price increases. Without them, organic growth would be even more modest.

Let’s also share some news here about a comparable company, as Rantalainen announced a significant acquisition in Norway today. The company has already steadily continued acquiring smaller offices.

With that acquisition, RAN Group is starting to be a truly significant player in the Nordics.

With the transaction, RAN Group serves nearly 40,000 customers with over 2,700 experts across more than 100 offices, and the group’s turnover will rise to 310 million euros (pro forma).

Once again, a small amount of capital was allocated🤝 This is likely already the seventh deal this year.

Yrityspalvelu Instament Oy’s turnover for the financial year ending December 31, 2024, was approximately 774 thousand euros. At the time of the transaction, the company employs two entrepreneurs and seven professionals. The entire company’s staff and entrepreneurs will continue to serve their customers as part of Aallon Group. Yrityspalvelu Instament Oy has accelerated its growth in recent years and its operations are very profitable.

Here are Ate’s comments on Aallon Group’s recent acquisition. ![]()

And more deals are coming.

Accounteria Oy’s turnover for the fiscal year ended December 31, 2024, was approximately 523 thousand euros. At the time of the transaction, the company employs six professionals in addition to one entrepreneur.

Here is a new company report on Aallon Group from Ate. ![]()

We reiterate our Add recommendation for Aallon Group and a target price of 13.0 euros. We have incorporated the company’s two most recent acquisitions into our forecasts, which has led to a 3-4% increase in earnings estimates for the coming years. Aallon Group has clearly accelerated its acquisition pace, with 12 transactions seen from the company in the past year. In our opinion, the stock’s valuation (2026e adj. P/E 11x) appears moderate in relation to the company’s stable and strong cash flow generating business and its medium-term earnings growth prospects. The implementation of the organizational reform causes short-term uncertainty and costs, but enables the continuation of profitability improvement in the coming years.

It’s good that acquisition targets have been found again. However, I’ve started to worry that as the pace of acquisitions accelerated with the change of CEO, whether the discipline in selecting acquisition targets has remained the same. Especially since the CEO didn’t seem to have any previous accounting firm acquisitions under their belt. When you add the ongoing organizational change to this, I believe the risks have slightly increased.

I, on the other hand, have the opposite feelings. It felt like the previous CEO didn’t really close the business deals or was a bit too cautious and vague.

The new CEO has brought new energy to the deals.